Le Dr. Yvan Allaire pousse plus loin la réflexion sur la stratégie de convergence de BCE, qui a été discuté samedi sur Seeking Alpha.

Il affirme que les entreprises fondées sur un actionnariat familial et un contrôle via des actions à vote multiples, comme Rogers Communications et Quebecor ont plus de latitude pour mieux exécuter une stratégie de convergence.

Voir: http://www.lesaffaires.com/blogues/yvan-allaire/bell-canada-et-la-saga-de-la-convergence/542307

Pour notre article sur la stratégie de convergence de BCE voir:

http://seekingalpha.com/article/440281-bce-relies-again-on-a-convergence-strategy

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

A blog on the convergence of info-communications industries: communications, computing, electronics, entertainment, publications and education. Strategic, technological and financial analysis. English and French blog. Cette chronique traite de l’évolution des industries de l’information et des communications et couvre des aspects stratégiques, technologiques et financiers, comme l’économie du savoir et de l’innovation. L’auteur est Associé principal de Infocom Intelligence.

Labels

finance

(58)

strategy

(39)

innovation

(36)

technology

(29)

Internet

(25)

mobile internet

(25)

stratégie

(21)

applications

(20)

business models

(19)

mobile technologies

(17)

venture capital

(17)

Apple

(13)

télécommunications

(13)

consumer internet

(12)

media

(12)

telecommunications

(12)

mergers and acquisitions

(11)

video games

(11)

wireless

(11)

technologie

(10)

Android

(9)

technologies de l'information et des communications

(9)

téléphones intelligents

(5)

Showing posts with label business models. Show all posts

Showing posts with label business models. Show all posts

Tuesday, March 20, 2012

Saturday, March 17, 2012

New article on Seeking Alpha: BCE relies again on a convergence strategy

Our new article is available on Seeking Alpha: "BCE relies again on a convergence strategy".

http://seekingalpha.com/article/440281-bce-relies-again-on-a-convergence-strategy

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

http://seekingalpha.com/article/440281-bce-relies-again-on-a-convergence-strategy

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

Thursday, January 26, 2012

The business model of Twitter according to CEO Jack Dorsey

According to Jack Dorsey, the founder of Twitter, the company did not have a real business model until recently since they are now targeting advertising revenue. They concentrated on getting a critical mass of subscribers first which then gave rise to an exponential traffic growth. They now have more than 190 million users, which are tweeting 65 million times a day . Twitter’s market value has reached $7 billion in January 2012, according to SharesPost. Twitter’s new business model relies on charging for access to its full data stream. According to GigaOm , it will feature promoted tweets in search results and promoted trends in its trending topics . It will publicize sales and other deals. Twitter is even considering inviting users to pay to promote their Twitter accounts. Promoted tweets would represent a Twitter-specific version of Google AdWords. Thus, Twitter is still experimenting with new sources of revenues. As for Facebook, Telcos will have to determine if they want to have Twitter as a partner and at what conditions.

Jack Dorsey, the CEO and co-founder of Twitter recently gave an interview to TechCrunch:

"What is Twitter compared to Facebook, Google+ and other social networking services?

Twitter is different because we’ve always been about hosting public conversations, that are real-time to boot. There’s always been this perception that you need to tweet to use Twitter, but we see a huge number of people using it for the discovery of news, events, content and so on. Our focus on simplicity is another differentiating factor....

Twitter was obviously born from a blogging-centric mindset, but where we shine is real-time discovery, being able to open up Twitter and instantly see what’s going on in the world, or with your friends and family. When we recently redesigned the website, we focused a lot on the discovery part of the equation, making it very simple for people to get value out of Twitter without necessarily participating...

Twitter has just acquired Summify, in order to deliver relevant content to people, instantly.

In the long run, is Twitter going to become a destination for information, or a distribution channel that brings traffic to other websites?

The beautiful thing about the service is that it is both. The most amazing thing about Twitter is that it reaches every single device on the planet, from the cheapest phone to the most advanced smartphone. We’re not just about distribution, but also about people sharing content on Twitter.

Do you want to be a distribution channel or a destination site?

Well, it’s a blurry line, but in essence we think of every tweet as a destination on itself, while Twitter is also a mechanism for distribution of content.

It look a long time for Twitter to develop a business model, and it’s based on advertising. We can agree that Twitter is big in perception but comes up short when it comes to engagement and stickiness. Do you need the same level of engagement other social networks enjoy to make your business model work?

Twitter’s business model has been in development for quite some time, and it works. Advertisers use it and we see them coming back for more. The market has vetted, and confirmed that they want to keep using it. Twitter’s ‘Promoted’ products — including promoted tweets, accounts and trends — are currently seeing 3 to 5 percent engagement. We’re always looking to increase engagement, but I also think about other things, like that fact that our technology can have a positive impact on the world and how businesses interact with their customers.

So what you’re saying is that even with the extremely minimal exposure of ads that you deliver, engagement can still prove sufficient enough to make for lots of revenues down the line?

Absolutely, it’s huge. Every signal that we’re getting from both users and advertising proves to us that people want more of it.

What’s more important to you as a business right now: make money or get more users? And you can’t answer both.

Both. It’s not really a fair question. We think of revenue as not a destination but as oxygen that feeds the model and vice versa. You can’t build a product without revenue, but you can’t focus on revenue without having a product either. Twitter is an organic system and product. Time and time again, you see companies whose revenue model makes their products better, just look at how Google AdSense improved search.

Source of the interview: TechCrunch.

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

Jack Dorsey, the CEO and co-founder of Twitter recently gave an interview to TechCrunch:

"What is Twitter compared to Facebook, Google+ and other social networking services?

Twitter is different because we’ve always been about hosting public conversations, that are real-time to boot. There’s always been this perception that you need to tweet to use Twitter, but we see a huge number of people using it for the discovery of news, events, content and so on. Our focus on simplicity is another differentiating factor....

Twitter was obviously born from a blogging-centric mindset, but where we shine is real-time discovery, being able to open up Twitter and instantly see what’s going on in the world, or with your friends and family. When we recently redesigned the website, we focused a lot on the discovery part of the equation, making it very simple for people to get value out of Twitter without necessarily participating...

Twitter has just acquired Summify, in order to deliver relevant content to people, instantly.

In the long run, is Twitter going to become a destination for information, or a distribution channel that brings traffic to other websites?

The beautiful thing about the service is that it is both. The most amazing thing about Twitter is that it reaches every single device on the planet, from the cheapest phone to the most advanced smartphone. We’re not just about distribution, but also about people sharing content on Twitter.

Do you want to be a distribution channel or a destination site?

Well, it’s a blurry line, but in essence we think of every tweet as a destination on itself, while Twitter is also a mechanism for distribution of content.

It look a long time for Twitter to develop a business model, and it’s based on advertising. We can agree that Twitter is big in perception but comes up short when it comes to engagement and stickiness. Do you need the same level of engagement other social networks enjoy to make your business model work?

Twitter’s business model has been in development for quite some time, and it works. Advertisers use it and we see them coming back for more. The market has vetted, and confirmed that they want to keep using it. Twitter’s ‘Promoted’ products — including promoted tweets, accounts and trends — are currently seeing 3 to 5 percent engagement. We’re always looking to increase engagement, but I also think about other things, like that fact that our technology can have a positive impact on the world and how businesses interact with their customers.

So what you’re saying is that even with the extremely minimal exposure of ads that you deliver, engagement can still prove sufficient enough to make for lots of revenues down the line?

Absolutely, it’s huge. Every signal that we’re getting from both users and advertising proves to us that people want more of it.

What’s more important to you as a business right now: make money or get more users? And you can’t answer both.

Both. It’s not really a fair question. We think of revenue as not a destination but as oxygen that feeds the model and vice versa. You can’t build a product without revenue, but you can’t focus on revenue without having a product either. Twitter is an organic system and product. Time and time again, you see companies whose revenue model makes their products better, just look at how Google AdSense improved search.

Source of the interview: TechCrunch.

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

Thursday, January 19, 2012

The art of tech start-up pivoting

There is a interesting article in the NY Times on the art of tech start-up pivoting.

“In the legal and entertainment industry, you can only fail so many times,” Professor Hosanagar said. “But the culture of Silicon Valley is one where failure is embraced.”

A VC adds it is easier when you are a small start-up to pivot and change the business model, since few will notice. For Ben Horowitz, one of the founders of the venture capital firm Andreessen Horowitz. “The art of the pivot is to do it fast and early. The older and bigger the business, the harder it is to change directions.”

Sometimes a pivot is necessary when the pace of Internet evolution has made a start-up’s original plan obsolete. “The Web we were building for a few years ago is almost no longer relevant,” said Michael LaValle, the co-founder of Gojee, a recipe recommendations app. “The Internet changes so fast.”

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalyis

“In the legal and entertainment industry, you can only fail so many times,” Professor Hosanagar said. “But the culture of Silicon Valley is one where failure is embraced.”

A VC adds it is easier when you are a small start-up to pivot and change the business model, since few will notice. For Ben Horowitz, one of the founders of the venture capital firm Andreessen Horowitz. “The art of the pivot is to do it fast and early. The older and bigger the business, the harder it is to change directions.”

Sometimes a pivot is necessary when the pace of Internet evolution has made a start-up’s original plan obsolete. “The Web we were building for a few years ago is almost no longer relevant,” said Michael LaValle, the co-founder of Gojee, a recipe recommendations app. “The Internet changes so fast.”

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalyis

Sunday, December 11, 2011

The future of the Internet in 3 trends according to the CEO of Forrester Research

3 trends will influence considerably the Internet, according to the CEO of Forrester Research George Colony.

1-The Internet will offers more applications.

2-The social network sector is due for an important transformation.

3-The entreprise sector will adopt massively the social networks

So, social will still prosper but it will evolve a lot.

George Colony suggests that in each decade we saw the turnaround of a major infocom player. In the 1980's it was Intel, in the 1990's it was IBM, in the 2000's it was Apple and he suggests in 2010's it could be Microsoft, but it would necessitates a leadership transformation.

Social networks have reach maturation in term of users' time and penetration rate among population (over 80% in US and Canada for example).

Social start-ups who don't understand this new rule and consider there is a social bubble will disappear. Strong business models are pre-requisite for post-social survival.

In order to use the Internet more effectively and efficiently, Internet applications (web applications and mobile applications) will prosper.

Forrester provided a graph Total offerings versus Strategy of the major infocom players. While Apple is at the top with a strong offering and a strong strategy, luck helped also Steve Jobs. Apple did not really anticipate the proliferation of mobile apps. However, the business model of Apple could leverage that unanticipated new trend.

To watch the whole video from Le Web conference see:

http://youtu.be/2XZNsBz0aGw

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

1-The Internet will offers more applications.

2-The social network sector is due for an important transformation.

3-The entreprise sector will adopt massively the social networks

So, social will still prosper but it will evolve a lot.

George Colony suggests that in each decade we saw the turnaround of a major infocom player. In the 1980's it was Intel, in the 1990's it was IBM, in the 2000's it was Apple and he suggests in 2010's it could be Microsoft, but it would necessitates a leadership transformation.

Social networks have reach maturation in term of users' time and penetration rate among population (over 80% in US and Canada for example).

Social start-ups who don't understand this new rule and consider there is a social bubble will disappear. Strong business models are pre-requisite for post-social survival.

In order to use the Internet more effectively and efficiently, Internet applications (web applications and mobile applications) will prosper.

Forrester provided a graph Total offerings versus Strategy of the major infocom players. While Apple is at the top with a strong offering and a strong strategy, luck helped also Steve Jobs. Apple did not really anticipate the proliferation of mobile apps. However, the business model of Apple could leverage that unanticipated new trend.

To watch the whole video from Le Web conference see:

http://youtu.be/2XZNsBz0aGw

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

Monday, November 21, 2011

How a firm can build a sustainable competitive advantage

According to Fred Wilson, a famous venture capitalist at Union Square Ventures, a company needs some requirements to build a competitive advantage, and it is not necessarily what is taught in business school.

"But as I look at many of the challenges facing businesses today, it seems to me that the focus on performance and efficiency often comes at the cost of sustainability. And interview with Clay Christensen really drives that point home. The recent history of the steel industry in the US is a case study in managers doing everything they were taught in business school and in the end they bankrupt the business.

Going back to business school, they teach you the value of a business is equal to the present value of future cash flows. If the company is likely to stay in business forever, then the value is most likely way higher than a business that is going to be out of business in a decade. The present value of a hundred years of cash flow is likely to be larger than the present value of ten years of cash flow.

And sustainability is all about figuring out how to be in business forever. It is about business models that are win/win and lead to happy long term customer and supplier relationships. It is about avoiding the temptation to overeach. It is about avoiding the temptation to mazimize near term profits at the expense of long term health. It is about adapting the business to changing market dynamics. It is about building a team and a culture that can survive the loss of the leader and keep going. And it is about many more things like this."

Source:http://www.avc.com/a_vc/2011/11/sustainability.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+AVc+%28A+VC%29

It is the same investment philosophy for Warren Buffet. He dislike managers who don't have long term plans. For Warren Buffet, the best stocks represent investing in companies with sustainable competitive advantages and forget the price of the stock for 5 years.

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

"But as I look at many of the challenges facing businesses today, it seems to me that the focus on performance and efficiency often comes at the cost of sustainability. And interview with Clay Christensen really drives that point home. The recent history of the steel industry in the US is a case study in managers doing everything they were taught in business school and in the end they bankrupt the business.

Going back to business school, they teach you the value of a business is equal to the present value of future cash flows. If the company is likely to stay in business forever, then the value is most likely way higher than a business that is going to be out of business in a decade. The present value of a hundred years of cash flow is likely to be larger than the present value of ten years of cash flow.

And sustainability is all about figuring out how to be in business forever. It is about business models that are win/win and lead to happy long term customer and supplier relationships. It is about avoiding the temptation to overeach. It is about avoiding the temptation to mazimize near term profits at the expense of long term health. It is about adapting the business to changing market dynamics. It is about building a team and a culture that can survive the loss of the leader and keep going. And it is about many more things like this."

Source:http://www.avc.com/a_vc/2011/11/sustainability.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+AVc+%28A+VC%29

It is the same investment philosophy for Warren Buffet. He dislike managers who don't have long term plans. For Warren Buffet, the best stocks represent investing in companies with sustainable competitive advantages and forget the price of the stock for 5 years.

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

Friday, November 04, 2011

New article on Seeking Alpha: 8 fast growing infomediation players

My new article on Seeking Alpha "8 fast growing infomediation players" is available at:

http://seekingalpha.com/article/305377-8-fast-growing-infomediation-players

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

http://seekingalpha.com/article/305377-8-fast-growing-infomediation-players

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

Monday, October 17, 2011

Infocom convergence war: Apple vs Google vs Facebook vs Amazon

The magazine Fast Company discusses this month the actual infocom war which oppose 4 corporate titans involved in many infocom sub-sectors. CNBC made an interview with the editor-in-chef.

It appears that very recently you could describe these 4 titans in few words: Apple did consumer electronics. Google did search, Amazon a web store and Facebook a social site. Each tech titan pushing further into mobile tablets, apps, cloud data and beyond. Fast Company offers four scenarios where each titan could emergence as a big winner of this tech war.

"In some ways their competition with each other will continue to elevate them ahead of the rest of the pack, but their actions and their ambitions are driving them into each other's areas. whether that's Google launching a social network, Amazon launching an ipad competitor, these companies are definitely looking for the same larger opportunities in mobile and media and data. and that's driving them into each other's areas. You know, at the same time they are setting the agenda for wide swaths of the rest of the economy. it's other folks who are forced to respond and react to what these guys are doing... I think the question here for investors is where will the profits go? right now apple is in the driver seat in terms of how big their profits are, the cash they're generating, the growth we're seeing from them.

But to put it in retail terms, this is like a battle between the Nordstrom, Walmart and Target models. i put Apple in the Nordstrom category, Google and Facebook are more Walmart. You sort of trade convenience for a little bit more of an open ecosystem but doesn't work quite as well. and Target is more of Amazon's model. They're really selling commerce, all these other things are feeding you into buying things from Amazon. I think that's the real issue is which one of those models wins out. I think they're all at slightly different life stages too. amazon ig@ on track to be the fastest company to reach $100 billion in revenues projected by I think 2015. That's tremendously fast."

"At the same time as you mention, Apple is making so much money and i think it takes apple about nine days to generate what Facebook generates in a year in revenue. But Facebook does have 800 million customers, right? users, and they have data from those folks on what they like and how they end up using that data may be tremendously valuable in the years ahead... How do you define actually winning? is it the amount of money they make, their entrepreneurship and innovative skills or the products they put out. or is it all of that? certainly from an investing point of view making money's important."

http://video.cnbc.com/gallery/?video=3000051097

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

It appears that very recently you could describe these 4 titans in few words: Apple did consumer electronics. Google did search, Amazon a web store and Facebook a social site. Each tech titan pushing further into mobile tablets, apps, cloud data and beyond. Fast Company offers four scenarios where each titan could emergence as a big winner of this tech war.

"In some ways their competition with each other will continue to elevate them ahead of the rest of the pack, but their actions and their ambitions are driving them into each other's areas. whether that's Google launching a social network, Amazon launching an ipad competitor, these companies are definitely looking for the same larger opportunities in mobile and media and data. and that's driving them into each other's areas. You know, at the same time they are setting the agenda for wide swaths of the rest of the economy. it's other folks who are forced to respond and react to what these guys are doing... I think the question here for investors is where will the profits go? right now apple is in the driver seat in terms of how big their profits are, the cash they're generating, the growth we're seeing from them.

But to put it in retail terms, this is like a battle between the Nordstrom, Walmart and Target models. i put Apple in the Nordstrom category, Google and Facebook are more Walmart. You sort of trade convenience for a little bit more of an open ecosystem but doesn't work quite as well. and Target is more of Amazon's model. They're really selling commerce, all these other things are feeding you into buying things from Amazon. I think that's the real issue is which one of those models wins out. I think they're all at slightly different life stages too. amazon ig@ on track to be the fastest company to reach $100 billion in revenues projected by I think 2015. That's tremendously fast."

"At the same time as you mention, Apple is making so much money and i think it takes apple about nine days to generate what Facebook generates in a year in revenue. But Facebook does have 800 million customers, right? users, and they have data from those folks on what they like and how they end up using that data may be tremendously valuable in the years ahead... How do you define actually winning? is it the amount of money they make, their entrepreneurship and innovative skills or the products they put out. or is it all of that? certainly from an investing point of view making money's important."

http://video.cnbc.com/gallery/?video=3000051097

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Tuesday, September 13, 2011

Mobile Internet will surpass fixed Internet in 2015

According to IDC, tablets and smartphones will drive significantly the consumption of mobile Internet. It will surpass fixed Internet (PC) around 2015 in the number of users. New players such as Amazon in tablets, will push mobile Internet.

This will drive new business models to create value from mobile Internet users.

Fixed and mobile Internet users will increase from 2 billion in 2010 to around 2.7 billion in 2015.

For more analysis on the modifications of technology business models you can read, in the coming weeks the Chapter of the Book:

"Rethinking North American telephony business models in the age of turbulence."

From Louis Rhéaume, TELUQ and Yves Rabeau, UQÀM.

In the book In: Advances in Communications… Volume 8 ISBN # 978-1-61324-794-5

Editor: Anthony V. Stavros, pp. 1- 40 © 2011 Nova Science Publishers, Inc.

Available (forthcoming Q4-2011) on the website:

https://www.novapublishers.com/catalog/product_info.php?products_id=25245

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

This will drive new business models to create value from mobile Internet users.

Fixed and mobile Internet users will increase from 2 billion in 2010 to around 2.7 billion in 2015.

For more analysis on the modifications of technology business models you can read, in the coming weeks the Chapter of the Book:

"Rethinking North American telephony business models in the age of turbulence."

From Louis Rhéaume, TELUQ and Yves Rabeau, UQÀM.

In the book In: Advances in Communications… Volume 8 ISBN # 978-1-61324-794-5

Editor: Anthony V. Stavros, pp. 1- 40 © 2011 Nova Science Publishers, Inc.

Available (forthcoming Q4-2011) on the website:

https://www.novapublishers.com/catalog/product_info.php?products_id=25245

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Sunday, June 05, 2011

For Marc Andreessen "Mr. Internet" : we are not in a second tech bubble

For Marc Andreessen "Mr. Internet" : we are not in a second tech bubble. Marc is the founder of Netscape who created Internet with images. He is now a Venture capitalist involved in Groupon, Twitter, Facebook, Zynga. He is making a tons of millions in profits from its internet investments. He suggests that right now, major tech stocks are undervalued on the stock markets: for instance Cisco Systems, Apple, Microsoft. He said that Apple's Price-Earnings (PE) ratio is just 10 if you delete cash. He suggests that fast growing valuations of private and public stocks are not general, but in fact isolated, mainly in social networks (Faceboook, Zynga, Linkedin).

For Marc, new tech companies are trying to become profitable companies and not just new promising new IPOs (Initial Public Offerings) like firms in 1999-2000. They tend to have stronger business models than in the last decade.

For the whole interview on the Wall Street Journal see

http://online.wsj.com/video/groupon-investor-marc-andreessen-no-tech-bubble/275ED9C5-2BCA-4BFD-9FBA-97BCEF0D48F7.html

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

For Marc, new tech companies are trying to become profitable companies and not just new promising new IPOs (Initial Public Offerings) like firms in 1999-2000. They tend to have stronger business models than in the last decade.

For the whole interview on the Wall Street Journal see

http://online.wsj.com/video/groupon-investor-marc-andreessen-no-tech-bubble/275ED9C5-2BCA-4BFD-9FBA-97BCEF0D48F7.html

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

Friday, May 20, 2011

IBM has now a bigger market capitalization than Microsoft.

IBM, which really launched the PC revolution, has now a bigger value (market capitalization) than Microsoft ($208.07B vs. $207.95B). IBM was the dominant PC manufacturer in the 1980's. It has sub-contracted the two most profitable components of a PC: the chip to Intel and the operating system to Microsoft. Wintel became very profitable and the 800 pounds gorillas in the computing industry, while IBM needed an electroshock by hiring Lou Gerstner in the 1990'S.

IBM makes a lot of profits now in the business and computing services and is less a manufacturer. By acquiring PriceWaterhouse, IBM made an important transition. Now they are acquiring aggressively in the promising cloud-computing services sector.

On the other hand, Microsoft may have a ton of liquidity, but the market is skeptic about the growth it can provide in the future. Microsoft's stock had a bad decade. The acquisition of Skype makes sense strategically, by complementing its products and services portfolio, but the acquisition price requires huge growth in revenue and profits, to recover this investment.

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

IBM makes a lot of profits now in the business and computing services and is less a manufacturer. By acquiring PriceWaterhouse, IBM made an important transition. Now they are acquiring aggressively in the promising cloud-computing services sector.

On the other hand, Microsoft may have a ton of liquidity, but the market is skeptic about the growth it can provide in the future. Microsoft's stock had a bad decade. The acquisition of Skype makes sense strategically, by complementing its products and services portfolio, but the acquisition price requires huge growth in revenue and profits, to recover this investment.

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Twitter: @InfocomAnalysis

Saturday, April 16, 2011

Tech bubble version 2.0, what have we learned from the krash of 2001?

It is widely known that the main reason behind the stock krash of 2001 was the lack of sound business models supporting the growth of tech, and mostly Internet stocks. In 1999 and 2000 any company with the name ".com" in it, got premium valuation on the stock exchanges. My ex-boss made a fortune with Year 2000 computing conversion systems (Y2K). It appeared a scam, nothing happened except on 2-3 elevators on the planet on January 1, 2000. My ex-boss diversified by acquiring 50 tech firms in unrelated computing sectors. He had no decent business model. The stock went to $60 to $3 and was acquired around $4.75 around 2002. During the tech bubble, most of the stocks, even the poorly managed, got huge market upside. It was easy to buy new firms with stocks with huge paper value and almost no cash. Due diligence was often discarded for "instincts". Because a target offered the ex-boss $6 per share for his firm, he thought that offering him $4.75 per share right away was a good idea. The owner of the target declined. With the help of the CFO I found with some basic financial analysis that the financial projections from the firm (so truely over-optimistic) gave a valuation below $1 per share. In fact the firm with a ".com" in the name went bankrupt 2 years later.

The tech firms which passed through the deep recession of 2001-2002 were the ones with the strong business models. Amazon with its e-commerce powerhouse evolved into a cloud-computing powerhouse and with high digital sales. eBay prospered as an electronic exchange. Pets.com went bankrupt with no decent business model. Several telecom Competitive Exchange Locals Carriers (CLEC) went bankrupt in Canada and USA because they had a me-too business model with no real strategic sustainable advantage. The same thing is happenning right now with "me-too" Groupon competitors.

For more analysis on the need for a strong business model you can read in the coming months the chapter : "Rethinking North American telephony business models in the age of turbulence" in the book "Telecommunications: Regulations, Technology and Economics" by Nova Science Publishers.

Authors: Louis Rhéaume, TELUQ-UQAM and Dr. Yves Rabeau, UQAM.

www.novapublishers.com

Bloomberg made a good point that in social networks there is a big Internet bubble emerging with high valuations such as Facebook, Zynga, Groupon and Twitter. The one with the weakest business model is Twitter, which is still experimenting with a coherent business model.

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

The tech firms which passed through the deep recession of 2001-2002 were the ones with the strong business models. Amazon with its e-commerce powerhouse evolved into a cloud-computing powerhouse and with high digital sales. eBay prospered as an electronic exchange. Pets.com went bankrupt with no decent business model. Several telecom Competitive Exchange Locals Carriers (CLEC) went bankrupt in Canada and USA because they had a me-too business model with no real strategic sustainable advantage. The same thing is happenning right now with "me-too" Groupon competitors.

For more analysis on the need for a strong business model you can read in the coming months the chapter : "Rethinking North American telephony business models in the age of turbulence" in the book "Telecommunications: Regulations, Technology and Economics" by Nova Science Publishers.

Authors: Louis Rhéaume, TELUQ-UQAM and Dr. Yves Rabeau, UQAM.

www.novapublishers.com

Bloomberg made a good point that in social networks there is a big Internet bubble emerging with high valuations such as Facebook, Zynga, Groupon and Twitter. The one with the weakest business model is Twitter, which is still experimenting with a coherent business model.

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Wednesday, April 13, 2011

An interesting article about the need for new business models

There was an interesting article in VentureBeat by the former president of Newsweek about the need for new business models.

http://venturebeat.com/2011/04/12/how-to-start-a-business-that-defies-traditional-models/

Here are some advices:

Don’t assume that a new model is the only way to go – Be sure your company actually needs, or would benefit from, a new business model. Even in a changing environment, your business opportunities may be served better by altering an existing model.

Don’t overestimate the changes – Change happens incrementally, so even though you may be moving in a new direction, your model still needs to be anchored historically.

Don’t allow “trying for great” to destroy the good – Just because you are building a new model, focus on the low-hanging fruit before shooting for the stars. Many of the first iPad apps, for example, were dizzyingly digital but slow to download and hard to use. Sales dropped dramatically after the initial excitement as a result.

Build flexibility into your model – It’s always good, for example, to overestimate the time it will take to achieve your goals. Like software, it always takes longer and costs more than anyone could have imagined at the beginning.

Expect competition – If you are going to eat your competitors’ lunch, they will notice – and will try very hard to prevent you from doing so. Build competitive response into your model.

Finally, ignore the critics. There will always be someone who doesn’t understand what you are doing, or doesn’t want to understand. But, they will have an opinion. Once you have launched your plan, stick with it until you know it is working or it just cannot work. Don’t give up too soon.

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

http://venturebeat.com/2011/04/12/how-to-start-a-business-that-defies-traditional-models/

Here are some advices:

Don’t assume that a new model is the only way to go – Be sure your company actually needs, or would benefit from, a new business model. Even in a changing environment, your business opportunities may be served better by altering an existing model.

Don’t overestimate the changes – Change happens incrementally, so even though you may be moving in a new direction, your model still needs to be anchored historically.

Don’t allow “trying for great” to destroy the good – Just because you are building a new model, focus on the low-hanging fruit before shooting for the stars. Many of the first iPad apps, for example, were dizzyingly digital but slow to download and hard to use. Sales dropped dramatically after the initial excitement as a result.

Build flexibility into your model – It’s always good, for example, to overestimate the time it will take to achieve your goals. Like software, it always takes longer and costs more than anyone could have imagined at the beginning.

Expect competition – If you are going to eat your competitors’ lunch, they will notice – and will try very hard to prevent you from doing so. Build competitive response into your model.

Finally, ignore the critics. There will always be someone who doesn’t understand what you are doing, or doesn’t want to understand. But, they will have an opinion. Once you have launched your plan, stick with it until you know it is working or it just cannot work. Don’t give up too soon.

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Wednesday, February 23, 2011

Research In Motion: Target Price of $88 Reachable in a Year, published at Seeking Alpha

Article selected by Seeking Alpha on Research in Motion's valuation

http://seekingalpha.com/article/254398-research-in-motion-target-price-of-88-reachable-in-a-year

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

http://seekingalpha.com/article/254398-research-in-motion-target-price-of-88-reachable-in-a-year

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Monday, February 14, 2011

L'innovation et les TIC (Technologies de l'Information et des Communications)

Un récent rapport du CEFRIO et DMR explique l’importance de l’innovation avec les Technologies de l’Information et des Communications (TIC). Il soulève les 6 grandes catégories d’innovation : modèles d’affaires, commerciale, organisationnelle, de produit, de procédé et technologique.

L’innovation par modèle d’affaires vient influencer le caractère de l’entreprise, ses clients, ses marchés-cibles, l’offre à ses clients, les intervenants à mobiliser, tout le processus et les réseaux de création de valeur. Cette innovation engendre souvent des besoins d’innovation technologique pour en soutirer la faisabilité et la viabilité. Magretta du Harvard Business Review soutient que pour se positionner et devenir un leader dans son secteur, une entreprise se doit de développer un processus systématique et stratégique d’innovation du modèle d’affaires. Pour en savoir plus sur la redéfinition de modèles d’affaires en télécommunications, revenez sur ce blogue : j’ai écrit un chapitre de livre avec le Dr. Yves Rabeau de l’UQÀM qui sera publié sous peu.

Louis Rhéaume

Infocom Intelligence

Tuesday, February 01, 2011

Article on LinkedIn business model published on Seeking Alpha

One of my article has been selected for exclusive publication on Seeking Alpha.

LinkedIn Experimenting With New Business Models

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

LinkedIn Experimenting With New Business Models

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Sunday, November 21, 2010

What 2 of the best Venture capitalists are saying on the future of the Internet ?

http://www.youtube.com/watch?v=nBvuirDPHKA&feature=player_embedded

Last week, 2 of the best Tech VC (venture capitalist) gave their perspective on the Internet for the Web 2.0 Techcrunch summit. John Doerr of Kleiner Perkins, the man behind the success of Netscape, Facebook and Google just to name a few; and Fred Wilson of Union Square Ventures who made the deal of Zynga made very interesting remarks on the future of the Internet.

For Wilson, we are in the middle of a second Internet stock market bubble. I agree with him, but I think we are at the beginning (see post http://infocomanalysis.blogspot.com/2010/10/are-we-entering-in-second-internet.html). For Doerr we are just in a boom period of a third waves of value creation and innovation about Internet. For Wilson, tech VC firms are seeing a lot of firms which copy the strategy of others. Thus, there are a lot right now of "Me too" business models. For instance, a lot of firms try to copy the success of Groupon in local daily social networks deals. It is similar to what happened in telephony in the 1990's where CLECS (Competitive Local Exchanges Carriers) had almost all the same strategy and business models. The vast majority went in bankruptcy following the burst of the 2000 tech stock bubble.

According to Wilson only 10% of firms in a VC portfolio should go public, the best ones only. The rest should try to sell to others firms.

For Doerr, the Silicon Valley is still the place where important Internet platforms still emerge and grow. For him, it has never been a better time to start a tech firm than today. Valuations are high and VC money is largely available.

For Wilson, a very hot sector right now is the combination between mobile and social networks. One can think of the potential of Twitter and Groupon for instance in this sector. He adds that Android will become the dominant platform on mobile because of its open standard platform versus Apple and Research in Motion (RIM and its Blackberry). Application developpers can create more easily value on this platform. Wilson proposes that Apple is like the "cable providers" business model of mobile Internet.

Doerr suggests that Facebook, is the strongest firm on execution of the Internet with Google, Apple, and Amazon.

Wilson suggests that Facebook did not create much innovation. Furthermore, the only complementor of its platform, which created a lot of value is Zynga. He also suggests that Google is the best tech acquirer since a decade.

John Doerr had the final word. He cited Colin Powell who said: "Innovation without execution is hallucination".

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Last week, 2 of the best Tech VC (venture capitalist) gave their perspective on the Internet for the Web 2.0 Techcrunch summit. John Doerr of Kleiner Perkins, the man behind the success of Netscape, Facebook and Google just to name a few; and Fred Wilson of Union Square Ventures who made the deal of Zynga made very interesting remarks on the future of the Internet.

For Wilson, we are in the middle of a second Internet stock market bubble. I agree with him, but I think we are at the beginning (see post http://infocomanalysis.blogspot.com/2010/10/are-we-entering-in-second-internet.html). For Doerr we are just in a boom period of a third waves of value creation and innovation about Internet. For Wilson, tech VC firms are seeing a lot of firms which copy the strategy of others. Thus, there are a lot right now of "Me too" business models. For instance, a lot of firms try to copy the success of Groupon in local daily social networks deals. It is similar to what happened in telephony in the 1990's where CLECS (Competitive Local Exchanges Carriers) had almost all the same strategy and business models. The vast majority went in bankruptcy following the burst of the 2000 tech stock bubble.

According to Wilson only 10% of firms in a VC portfolio should go public, the best ones only. The rest should try to sell to others firms.

For Doerr, the Silicon Valley is still the place where important Internet platforms still emerge and grow. For him, it has never been a better time to start a tech firm than today. Valuations are high and VC money is largely available.

For Wilson, a very hot sector right now is the combination between mobile and social networks. One can think of the potential of Twitter and Groupon for instance in this sector. He adds that Android will become the dominant platform on mobile because of its open standard platform versus Apple and Research in Motion (RIM and its Blackberry). Application developpers can create more easily value on this platform. Wilson proposes that Apple is like the "cable providers" business model of mobile Internet.

Doerr suggests that Facebook, is the strongest firm on execution of the Internet with Google, Apple, and Amazon.

Wilson suggests that Facebook did not create much innovation. Furthermore, the only complementor of its platform, which created a lot of value is Zynga. He also suggests that Google is the best tech acquirer since a decade.

John Doerr had the final word. He cited Colin Powell who said: "Innovation without execution is hallucination".

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

Sunday, October 10, 2010

Consumer internet business models

AOL just acquired the tech news blog Techcrunch for US $25M. There was a recent interesting article concerning Consumer internet business models on this blog:

13 Ways To Get To $10 Million In Revenues (Part I).

The different business models can be read at:

Louis Rhéaume

Infocom Intelligence

louis@infocomintelligence.com

www.infocomintelligence.com

Sunday, September 03, 2006

Comment profiter de la convergence: les différents types de convergence, les types de consommateurs et les modèles d'affaires.

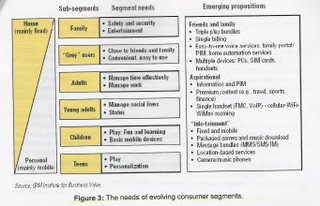

Un récent rapport de IBM donne quelques pistes intéressantes comment profiter des différents types de convergence. Il en ressort que certains types de convergence exercent des pressions plus fortes dans l'industrie des info-communication.

Louis Rhéaume

Associé Principal

Infocom Intelligence

www.infocomintelligence.com

Inspiré du rapport de Carlson, Jeanette; Chris Woodland and Henry Stevens, "Profiting from convergence: defining growth paths for telecom service providers", July 2006, Vol. 2, IBM

Un récent rapport de IBM donne quelques pistes intéressantes comment profiter des différents types de convergence. Il en ressort que certains types de convergence exercent des pressions plus fortes dans l'industrie des info-communication.

Tout comme l'industrie de l'informatique, l'industrie des télécommunications est en train de se désaggréger. Autrefois, l'ordinateur était concû en entier par un fabricant qui était intégré verticalement. Ainsi, tout était fabriqué par la même firme: système d'opération, logiciel, composantes électroniques. Apple et IBM ont commencé à intégrer des firmes complémentaires qui ont fourni des produits et services à meilleur prix et meilleur qualité. Microsoft a obtenu le contrat du sytème d'exploitation du PC de IBM et Intel a fourni le microprocesseur. Aujourd'hui, IBM a abandonné la fabrication de PC aux mains du chinois Lenovo puisque ses marges étaient très faible dans le secteur manufacturier. La grande valeur ajoutée dans la chaine de valeur de l'informatique s'est développé aux extrémités, soit le système d'exploitation et le microprocesseur.

Il est en train de se passer une situation similaire avec les télécommunications. Le transport de données se fait à des prix très bas tandis que les firmes aux extrémités de la chaîne de valeur profitent grandement de l'Internet comme Skype et les fournisseurs de contenu.

Un facteur clé de création de valeur est le focus de types de clientèle. Dell a révolutionné il y a 20 ans la vente d'ordinateur en privilégiant le service direct à des clients plus sophistiqués et expérimentés dans l'achat d'ordinateur sur-mesure. En télécommunications certains segments ont des besoins assez différents.

Le choix du focus de clientèle fait en sorte que la firme peut se spécialiser et renforcir ses compétences stratégiques pour mieux répondre à ce type de clientèle. Il en ressort que les firmes peuvent innover en offrant une nouvelle approche pour servir cette clientèle avec un modèle d'affaires plus innovateur.

Louis Rhéaume

Associé Principal

Infocom Intelligence

www.infocomintelligence.com

Inspiré du rapport de Carlson, Jeanette; Chris Woodland and Henry Stevens, "Profiting from convergence: defining growth paths for telecom service providers", July 2006, Vol. 2, IBM

Subscribe to:

Posts (Atom)