Quebecor (QBR-B.TO or QBCAF.PK) is a company in the Consumer discretionary sector and Publishing industry. It operates media businesses primarily through subsidiary Quebecor Media Inc. with activities in cable distribution, residential and business telecommunications, newspapers, broadcasting, retailing of books, magazines and videos, publishing and distribution, recording and distribution of music, the Internet and new media.

Fundamentals

Market Cap 2.3B Beta 0.19

Revenue (FYR) $3.8B EPS (TTM) $4.05

Shares Out. 64.3M Book Value $18.20

Dividend Yield 0.57% P/E 8.7x

Div/Share $0.20 Price/Sales (FYR) 0.6

Ex-Div Date 11/24/10 P/Cash Flow (TTM) 2.3x

Pay Date 12/21/10 Operating Margin 33.77%

Data delayed at least 15 minutes.

Segmented Data: 12 months ended Dec. 31/09

Revenue by industry

News media: 27.2%

Leisure & entertainment: 8.1%

Interactive technologies: 2.4%

Broadcasting: 11.6%

Telecommunications: 52.9%

Head office & intersegment: -2.3%

Operating income by industry

News media: 15.6%

Leisure & entertainment: 2.0%

Interactive technologies: 0.3%

Broadcasting: 6.3%

Telecommunications: 76.2%

Head office & intersegment: -0.4%

Capital expenditures by industry

News media: 6.8%

Leisure & entertainment: 0.7%

Interactive technologies: 0.6%

Broadcasting: 3.3%

Telecommunications: 87.8%

Head office: 0.8%

Forecasts provided by Thomson Reuters I/B/E/S - Updated weekly

Consensus Recommendation of 13 Analysts Buy

Consensus Target Price of 13 Analysts $43.50

Dvai Ghose of Canaccord Genuity has a buy rating on the stock relying mostly on its medium to long term prospects.

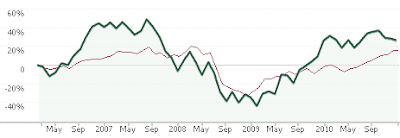

The stock is facing more competitive pressures and some segments are reaching maturity. Thus cable margins are near its peak, but cable telephony still has some potential. The cyclical recovery in the media advertising is also near its peak. Free cash flows are decreasing because of important capital investments in a 3.5G+ wireless network. Cash flows went from $321M in 2009 to $175M in 2010 (forecast). Mr. Ghose expects cash flows per share of $1.30 to $2.25 in 2011, $3.13 in 2012 and $4.11 in 2013.

Per Share Data QBR.B Industry

Earnings (TTM) $4.05 $1.89

Book Value $18.20 $17.97

Valuation

Price/Earnings 8.7x 15.4x

Price/Sales (FYR) 0.6x 1.6x

Price/Book (MRQ) 1.9x 2.6x

Price/Cash Flow (TTM) 2.3x 12.4x

Profitability (TTM)

Gross Margin 18.24% 9.94%

Operating Margin 33.77% 21.65%

Profit Margin 14.18% 8.09%

Mgmt Effectiveness (TTM)

Return on Assets 8.99% 6.77%

Return on Equity 26.87% 12.17%

Return on Investment 14.19% 8.39%

Dividend (TTM)

Annual Dividend Rate 0.20 0.64

Dividend Yield 0.57% 2.26%

Payout Ratio 0.1x 0.7x

Financial Strength (MRQ)

Debt to Capital 61.49% 29.28%

Current Ratio 1.0x 1.5x

Quick Ratio 0.7x 0.8x

Size

Market Cap $2.3B $1.0B

Revenue $3.8B $19.8B

Shares Outstanding 64.3M 631.3M

Employees 15,710 75,377

Mr. Ghose forecasts that Quebecor could increase significantly the dividend (actually $0.20$ per share) in 2012 and suggests a price target of $45. With an actual price of $34.90 it would represents a 29% return. The valuation measures compared to industry are much lower while profitability measures are higher. Furthermore, price the target of Mr. Ghose was made before two important press releases Quebecor this week.

1. Quebecor and its journalist ended a 2 years lock-out at Journal de Montréal, where the employer won important concessions from the employees (i.e. from 260 employees it would now be 62).

2. Since today, it is officially involve in the construction of a new arena in Quebec City where they will be the name sponsor and the manager of the building. They are betting on the acquisition of a NHL franchise and could made important benefits from events at the arena. Evenko, the event company of the Montreal Canadiens’ owners (Molson family) is making a lot of money in the second most used arena in North America (Bell Centre). The investment is $33M for the name without a hockey team and an annual rent of $3.15M or $63.5M with a hockey team and an annual rent of $5M.

With a better product portfolio of smartphones, Videotron (telephony division) will obtain more subscribers in the Canadian market, which is also one of the most expensive markets in the world for wireless packages. Cable telephony is still also in the growth stage. Investments in capital expenditures for the wireless networks is reducing Earnings per Share, but it is temporary.

Louis Rhéaume

Infocom Intelligence

Louis@infocomintelligence.com

A blog on the convergence of info-communications industries: communications, computing, electronics, entertainment, publications and education. Strategic, technological and financial analysis. English and French blog. Cette chronique traite de l’évolution des industries de l’information et des communications et couvre des aspects stratégiques, technologiques et financiers, comme l’économie du savoir et de l’innovation. L’auteur est Associé principal de Infocom Intelligence.

Labels

finance

(58)

strategy

(39)

innovation

(36)

technology

(29)

Internet

(25)

mobile internet

(25)

stratégie

(21)

applications

(20)

business models

(19)

mobile technologies

(17)

venture capital

(17)

Apple

(13)

télécommunications

(13)

consumer internet

(12)

media

(12)

telecommunications

(12)

mergers and acquisitions

(11)

video games

(11)

wireless

(11)

technologie

(10)

Android

(9)

technologies de l'information et des communications

(9)

téléphones intelligents

(5)

No comments:

Post a Comment